|

PRESS

RELEASES

Repossession

Trends 2003: Outlook for Trucks, Printing, and Construction

Brightened, But Some Other Equipment Categories Took Hits

Nassau

Asset Management Releases Results for 2003

ROSLYN

HEIGHTS, N.Y., Feb. 17, 2003—Repossessions of

trucks and trailers declined throughout all four quarters

of 2003, signaling good news for the U.S. trucking industry,

according to Nassau Asset Management's NasTrac Quarterly

Index (NQI). In other positive economic trends, repossessions

involving printing presses and construction equipment dropped

off during the final three quarters. Still, 2003 was not

a turnaround economic year for all types of equipment repossessions.

"Just

as the overall economy strengthened in 2003, we noted significant

improvements in three of the five top equipment repossession

categories that we resell - trucks, printing presses, and

construction. But 2003 was not completely rosy when you

analyze repossessions of some other types of equipment,"

says Ed Castagna, senior vice president of Nassau Asset

Management.

"While

there were 46 percent fewer repossessions of machine tools

overall in 2003, they had a roller-coaster year -- a very

strong start followed by a weaker showing in the final three

quarters. This may reflect the uneven recovery of the manufacturing

industry as a whole. Members of the Turnaround Management

Association, who are corporate renewal specialists, recently

picked manufacturing as one of the industries that suffered

the most during 2003," Castagna explains. "In

addition, there were actually more repossessions of medical

devices in 2003 than in 2002. This may have been due in

part to continuing regulatory and insurance pressures on

the industry."

Nassau

Asset Management has tracked equipment for several decades

as a function of its nationwide remarketing operation, which

resells all types of assets including trucks, construction

equipment, printing presses, machine tools, medical devices,

and buses. The company in 2003 launched NQI, which reports

on equipment types generating the greatest volume of liquidations.

NQI's

public data provides a snapshot of recent recovery and sales

activity compared with the same time frame a year before,

helping equipment leasing and finance companies forecast

current market conditions so they can evaluate the strengths

and weaknesses of their portfolios. When viewed over time,

NQI also can be leveraged as one of several components to

help gauge the economic health of individual industry sectors.

Nassau

clients can obtain more detailed information as part of

the NQI service, including customized data on specific types

of equipment and their values extending back to 2000.

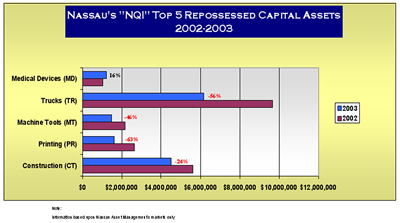

Top

Repossessions in 2003

The

NQI 2003 year-end analysis reports on trucks/trailers, printing

presses, medical devices, machine tools, and construction

equipment. These were the top five repossessed capital assets

in 2003, according to Nassau's internal records on liquidations.

Castagna

says the 2003 data, when compared with 2002, indicates:

- a

56 percent overall decrease in repossessions of trucks

and trailers. Trucks and trailers were the only one of

the five top equipment categories tracked that showed

improvement over all four quarters. Other positive trends

within the industry include the growth in commercial trucks

sales over the latter part of 2003 and projected into

2004, according to the Truck Renting and Leasing Association

(TRALA).

- a

63 percent overall drop in repossessions of printing presses.

Printing presses overcame a poor showing in Q1 2003 (up

141 percent compared with Q1 2002) to improve over the

last three quarters of the year. This correlates with

findings from the National Association of Printing Leadership

(NAPL), which reported in November that the printing industry

was "finally showing signs of what may be a sustainable

upturn, following more than two years of steep and broad

sales declines."

- a

24 percent overall decline in repossessions of construction

equipment. Construction equipment had a rough first quarter,

(up 452 percent from Q1 2002) but improved over the final

three quarters. Other signs of a strengthening construction

industry include a U.S. Commerce Department report released

Feb. 2 that showed construction spending in January rose

for the seventh consecutive month.

- a

16 percent overall increase in repossessions of medical

devices, despite a strong first quarter (down 63 percent

from Q1 2002). This may reflect a number of pressures

within the industry. A 2003 survey of members of the Advanced

Medical Technology Association (AdvaMed), for example,

painted a picture of "a highly competitive industry

that is increasing its focus on developing next-generation

and breakthrough technologies. The findings also paint

a picture of an industry that is encountering significant

FDA regulatory hurdles in getting these advances approved

as well as intense pressure to assure that their technologies

are cost saving or cost effective."

- a

46 percent overall decrease in repossessions of machine

tools. Repossessions of machine tools dropped dramatically

in Q1 (down 76 percent from Q1 2002), increased slightly

by 4 percent in Q2 compared with the same timeframe the

previous year, then jumped significantly during the final

two quarters (up 83 percent from Q3 2002 and 52 percent

from Q4 2002). Despite some positive news in the machine

tool industry during 2003, including reports of increased

demand in November, members of the Turnaround Management

Association recently picked manufacturing as one of the

industries that suffered the most during 2003.

Readers

should keep in mind that the assets NQI covers may change

from quarter to quarter since Nassau plans to feature only

the largest asset groups in its multimillion dollar portfolio.

Additionally, results must be viewed over several quarters

to establish reliable trends since all industries experience

cyclical changes.

To view

NQI charts on repossessions as they are available, please

visit the Web sites of equipment leasing and finance industry

trade journals or contact Nassau.

ABOUT NASSAU

Nassau

Asset Management of Roslyn Heights, NY, has been providing

full-service asset management, including asset recovery,

collections, remarketing, plant liquidations, and appraisals

for more than 25 years to the equipment leasing and finance

industry. For more information, please visit www.nasset.com

or call 1-800-4.NASSAU.

# # #

MEDIA

CONTACTS:

Edward

Castagna

Senior Executive Vice President

Nassau Asset Management

1-800.4.NASSAU, ext. 301

ecast@nasset.com

Carla Young Harrington

PR Agent for Nassau

540-899-3913

carla@crosslink.net

|