|

PRESS

RELEASES

Repossessors

Seized More Trucks in Q2

Nassau

Asset Management Announces Plans To Supplement Quarterly

Index on Repos with Emerging Trends Alerts

ROSLYN

HEIGHTS, NY., July 27, 2004—Nassau Asset Management's

NasTrac Quarterly Index (NQI) has identified a dramatic

increase in truck repossessions since first quarter.

Ed Castagna,

senior executive vice president of Nassau, said the figures

reflect recent turbulence within the industry despite an

overall drop in truck repossessions over the past two years.

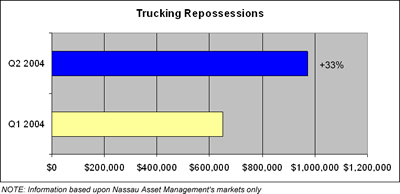

When viewed on an annual basis only, for example, there

were actually 47 percent fewer trucks repossessed in the

second quarter (Q2) of 2004 than in Q2 2003. However, when

comparing Q2 2004 to the first quarter of this year, truck

repossessions climbed 33 percent.

"Perhaps

the economy is not as robust as we are being told,"

Castagna says. "We are being asked to repossess more

trucks than we were earlier this year due to a number of

factors, including rising fuel prices and insurance costs."

New

Alerts Will Highlight Emerging Trends

Castagna

says his company's NQI also is detecting changes in the

volume of repossessions involving other equipment. As a

result, Nassau plans to supplement its quarterly index with

faster reports called Emerging Trends Alerts. Charts and

press releases summarizing both types of reports are available

free of charge to the public at http://www.nasset.com/newsroom/newsroom_nqi.htm.

"Finance

companies and industry analysts can also contract with Nassau

to dig deeper into the numbers, determining the root causes

for trends and researching specific equipment types,"

Castagna adds. "Companies can use their private reports

created by Nassau to help mitigate risk in portfolios and/or

provide useful economic indicators to their own clients."

Nassau

has tracked equipment trends for several decades as a function

of its nationwide remarketing operation, which recaptures

and resells all types of assets. Recognizing the value its

data holds for the equipment leasing and finance industry

and economic analysts, the company in 2003 launched NQI,

which reports on equipment types generating the greatest

volume of repossessions.

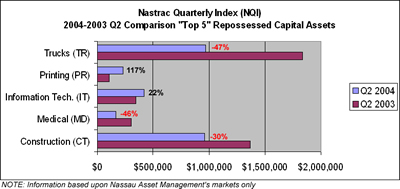

Top

Repossessions in Q2 2004 vs. Q2 2003

The

current NQI reports on trucks/trailers, printing presses,

information technology, medical devices and construction

equipment. These were the top five repossessed capital assets

in Q2 2004, according to Nassau's internal records on liquidations.

Castagna

says the Q2 data, when compared with the same quarter a

year ago, shows there was a 47 percent decrease in repossessions

of trucks, 46 percent drop in repossessions of medical devices

and 30 percent slide in repossessions of construction equipment.

At the same time, repossessions of printing presses jumped

by 117 percent and those of information technology rose

by 22 percent. Castagna says Nassau plans to monitor both

of these sectors closely to determine whether there are

economic reasons for the increase, or whether they simply

reflect Nassau's expanding base of clients that finance

these types of equipment.

Machine

tools did not make NQI's Top 5 as they did in Q1, another

indicator that this sector is brightening. The American

Machine Tool Distributors' Association recently reported

that year-to-date U.S. machine tool consumption through

May 2004 was $1,041.4 million, up 46.1% compared to 2003.

Readers should keep in mind that the assets NQI covers may

change from quarter to quarter since Nassau plans to feature

only the largest asset groups in its multimillion dollar

portfolio. Additionally, results must be viewed over several

quarters to establish long-term trends since all industries

experience cyclical changes.

ABOUT NASSAU

Nassau Asset Management of Roslyn Heights, NY, has been

providing full-service asset management, including asset

recovery, collections, remarketing, full plant liquidations,

and appraisals for more than 25 years to the equipment leasing

and finance industry. For more information, please visit

www.nasset.com or call

1-800-4.NASSAU.

# # #

MEDIA

CONTACTS:

Edward

Castagna

Senior Executive Vice President

Nassau Asset Management

1-800.4.NASSAU, ext. 301

ecast@nasset.com

Carla Young Harrington

PR Agent for Nassau

540-899-3913

carla@crosslink.net

|