|

PRESS

RELEASES

Fewer

Trucks Repossessed in the First Half of 2003, Reports Nassau

Asset Management's Quarterly Index

Index

tracks top repos, including printing presses, machine tools,

construction equipment, buses, and medical devices

ROSLYN

HEIGHTS, N.Y., Sept. 15, 2003-Fewer trucks were repossessed

in the first two quarters of 2003 than the same time last

year, another sign that the economy may be improving for

the trucking industry if clear trends can be established

over the next few quarters, according to Nassau Asset Management's

first public release of its NasTrac Quarterly Index (NQI).

NQI is based solely on the company's internal data.

Nassau

Asset Management has tracked equipment values for several

decades as a function of its nationwide remarketing operation,

which recaptures and resells all types of assets including

construction equipment, printing presses, machine tools,

and buses. Recognizing the value its historic and current

data holds for the equipment leasing and finance industry,

the nationwide asset management company launched NQI, which

reports on equipment types generating the greatest volume

of liquidations. Nassau clients can obtain more detailed

information as part of the NQI service, including customized

data on specific types of equipment.

Ed Castagna,

senior executive vice president, says NQI gives equipment

leasing and finance companies a tool to help mitigate risk.

It provides a snapshot of recent recovery and sales activity,

helping equipment leasing and finance companies forecast

current market conditions so they can make decisions regarding

their portfolios if they are heavy in the types of assets

experiencing the most repossessions as tracked by NQI.

"Nassau's

NQI also can be used as one of several components to help

gauge the economic health of individual industry sectors,"

Castagna adds. "Viewed over time, NQI's quarterly data

on repossessions can be compared with data from the previous

year to help identify which industry sectors may be experiencing

financial downturns, upturns, or cyclical changes."

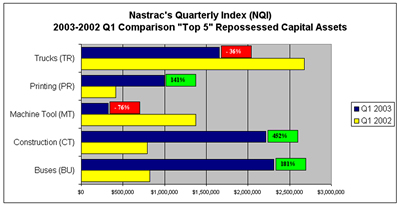

Top

Repossessions in 1Q 2003

The

first NQI reports on trucks/trailers, printing machines,

machine tools, construction equipment, and buses. These

were the top five repossessed capital assets in the first

quarter (1Q) of 2003, according to Nassau's internal records

on liquidations.

Castagna

says the 1Q data, when compared with the same quarter a

year ago, shows there was a 36 percent decrease in repossessions

of trucks and trailers, and a 76 percent decrease in repossessions

of machine tools. NQI's data on machine tools is in line

with findings released Sept. 7 by the American Machine Tool

Distributors Association and the Association for Manufacturing

Technology, which reported increased demand for machine

tools that could indicate a healthier manufacturing industry.

However,

other sectors suffered in 1Q 2003. Construction equipment

repossessions, for example, jumped 452 percent. Repossessions

involving printing presses increased by 141 percent, and

those involving buses by 181 percent.

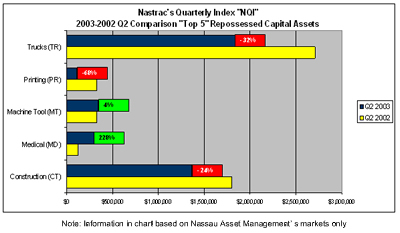

Top

Repossessions in 2Q 2003

The

second NQI reports on trucks/trailers, printing machines,

machine tools, medical equipment, and construction equipment.

These were the top five repossessed capital assets in the

second quarter (2Q) 2003, according to Nassau's internal

records on liquidations. Repossessions involving buses,

which dropped off the Top 5 list in 2Q, historically peak

in 1Q each year for Nassau Asset Management, Castagna says.

Castagna

says the 2Q data, when compared with the same quarter a

year ago, shows there was a 32 percent decrease in repossessions

of trucks/trailers. Repossessions of printing presses were

down by 68 percent and construction equipment by 24 percent

compared with the same time frame in 2002. Machine tools

did not perform quite as well, with repossessions increasing

slightly, by 4 percent. Medical devices made the Top 5 list

in 2Q, posting a 228 percent increase in repossessions compared

with 2Q 2002.

Users

should keep in mind that the assets NQI covers may change

from quarter to quarter since Nassau plans to feature only

the largest asset groups in its multimillion dollar portfolio.

Additionally, results must be viewed over several quarters

to establish reliable trends.

ABOUT

NASSAU

Nassau

Asset Management of Roslyn Heights, NY, has been providing

full-service asset management, including asset recovery,

collections, remarketing, plant liquidations, and appraisals

for more than 25 years to the equipment leasing and finance

industry. For more information, please visit www.nasset.com

or call 1-800-4.NASSAU.

# # #

MEDIA

CONTACTS:

Edward

Castagna

Senior Executive Vice President

Nassau Asset Management

1-800.4.NASSAU, ext. 301

ecast@nasset.com

Carla Young Harrington

PR Agent for Nassau

540-899-3913

carla@crosslink.net

|