|

PRESS

RELEASES

Fuel prices may be driving up some equipment repossessions

Nassau Asset Management notes repos rose in several sectors during Q1, Q2

WESTBURY

HEIGHTS, NY., Aug 31, 2005—Fuel costs may be contributing to an increase in equipment repossessions and liquidations nationwide, reports Nassau Asset Management, which tracked a rise in several sectors during the first two quarters of 2005. The company studies equipment trends as part of its equipment recovery, appraisal, collections and remarketing business.

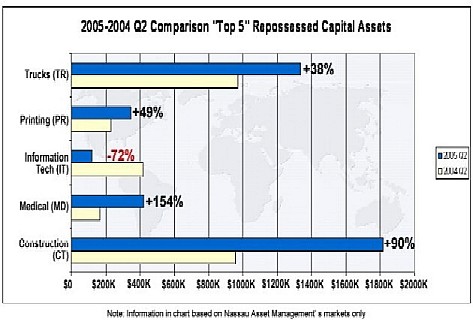

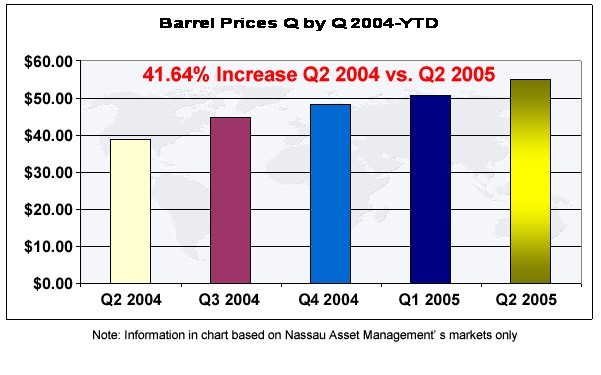

Nassau earlier this year noted that repossessions and liquidations during first quarter (Q1) rose significantly for the first time since 2002. In the company's latest NasTrac Quarterly Index (NQI), repossessions and liquidations during second quarter (Q2) 2005 compared with Q2 2004 increased in four of five categories: trucks/trailers (+38%); printing presses (+49%); medical devices (+154%); and construction equipment (+90%). Only information technology equipment fared better (-72%). An analysis of the many factors contributing to repossessions indicates that fuel prices may be having a greater impact than in the past.

"We feel fuel cost is a factor that can push a business already close to failing over the edge," said Edward Castagna, Nassau's president. "For trucking companies, fuel represents 25 percent of operating costs, according to the American Trucking Associations (ATA). The high price of fuel also is affecting more than truckers. It increases the cost of doing business for many companies."

Rising fuel prices have spiked even higher in recent days due to shutdowns in national oil production caused by Hurricane Katrina.

About NQI

NQI reflects Nassau's internal repossession and orderly liquidation activity in a given quarter compared to the same quarter the previous year. Readers should keep in mind that results must be viewed over several quarters to establish trends. Companies can contract with Nassau to dig deeper into the numbers, helping mitigate risk in portfolios and/or provide useful economic indicators.

"Finance

companies and industry analysts can also contract with Nassau

to dig deeper into the numbers, determining the root causes

for trends and researching specific equipment types,"

Castagna adds. "Companies can use their private reports

created by Nassau to help mitigate risk in portfolios and/or

provide useful economic indicators to their own clients."

About Nassau

Nassau Asset Management of Westbury, NY, has been providing full-service asset management, including equipment remarketing, fleet and plant liquidations, collections, and appraisals for more than 25 years to the equipment finance industry. For more information, please visit

www.nasset.com or call

1-800-4.NASSAU.

# # #

MEDIA

CONTACTS:

Edward

Castagna

1-800.4.NASSAU, ext. 301

ecast@nasset.com

Carla Young Harrington

Susan Carol Associates PR

540.899.3913

carla@crosslink.net

|