|

PRESS

RELEASES

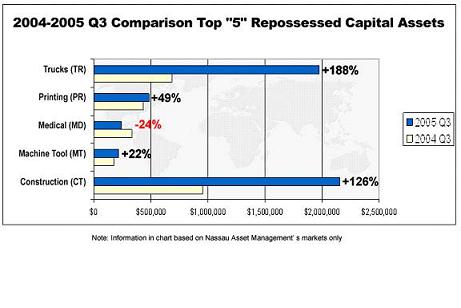

Truck, Construction Repossessions Show Increase in Q3

Nassau Asset Management notes repos up in many sectors, but not all;

Contributing factors include fuel costs, greater leasing activity

WESTBURY

NY., Nov 3, 2005—Equipment repossessions and liquidations nationwide continued to rise during the third quarter, most notably for trucks and construction machinery, reports Nassau Asset Management. Nassau's NasTrac Quarterly Index (NQI) reveals trends in repossessions and orderly liquidations based upon the company's own internal activity in a given quarter compared to the same quarter the previous year.

Nassau provides asset recovery, appraisal, collections, liquidation and remarketing services for equipment leasing and finance companies across the nation. The company earlier this year noted that repossessions and liquidations during the first two quarters of 2005 increased significantly for the first time since 2002. This trend continues through the third quarter.

Nassau provides asset recovery, appraisal, collections, liquidation and remarketing services for equipment leasing and finance companies across the nation. The company earlier this year noted that repossessions and liquidations during the first two quarters of 2005 increased significantly for the first time since 2002. This trend continues through the third quarter.

In the company's latest NQI, repossessions and liquidations during third quarter (Q3) 2005 compared with Q3 2004 increased in four of five categories: trucks/trailers (+188%); construction equipment (+126%); printing presses (+49%); and machine tools (+22%). However, repossessions and liquidations of medical devices decreased for the first time in 2005 (-24%).

Edward Castagna, president of the company, says several factors appear to be influencing the 2005 upswing in repossessions and liquidations for some equipment sectors.

"The obvious answer is that adverse economic conditions are driving up some repossessions. This is true, but not the whole story," Castagna explains.

"Fuel costs are among the adverse economic conditions affecting repossessions. There is no question in our minds that rising fuel costs earlier this year made it harder for truckers, construction companies and other firms to do business, which resulted in more repossessions," Castagna says. A September 2005 Duke University/CFO Magazine Business Outlook survey noted that chief financial officers cited high fuel costs as the number one concern for U.S. firms, surpassing high health care costs for the first time in the survey's history.

"Yet part of the increase in repossessions and liquidations may also be attributed to greater leasing activity by our clients in the equipment finance industry," Castagna adds. For example, if lease volume is up, even if delinquencies are as low as 1%, the numbers of liquidations and repossessions will rise.

The Equipment Leasing Association's (ELA) annual volume chart shows overall leasing volume peaked at $247 billion in 2000, then slipped to: $216 billion in 2001; $206 billion in 2002; and $194 billion in 2003. The most recent chart, which compiles data from the federal government and ELA, includes estimates by Financial Institutions Consulting that predicted 2004 volume would increase to $220 billion, with 2005 volume potentially topping the industry's $247 billion highpoint in 2000.

The ELA recently reported that new business volume in September reached $5.06 billion, the highest for any month in 2005 and an increase of 18.1% over new volume generated in August.

About NQI

NQI reports on Nassau's internal repossession and orderly liquidation activity in a given quarter compared to the same quarter the previous year. Readers should keep in mind that results must be viewed over several quarters to establish trends.

Finance companies and industry analysts can also contract with Nassau to dig deeper into the numbers, determining the root causes for trends and researching specific equipment types. Companies can use their private reports created by Nassau to help mitigate risk in portfolios and/or provide useful economic indicators to their own clients.

About Nassau

Nassau Asset Management of Westbury, NY, has been providing full-service asset management, including equipment remarketing, fleet and plant liquidations, collections, and appraisals for more than 25 years to the equipment finance industry. For more information, please visit

www.nasset.com or call

1-800-4.NASSAU.

# # #

MEDIA

CONTACTS:

Edward

Castagna

1-800.4.NASSAU, ext. 301

ecast@nasset.com

Carla Young Harrington

Susan Carol Associates PR

540.899.3913

carla@crosslink.net

|